The Treasury says that the changes will save £4.5bn a year from 2016.

And it claims most working families will still be better off by 2017, as a result of the introduction of the National Living Wage (NLW) and changes to income tax thresholds.

But the independent Institute for Fiscal Studies (IFS) says that millions of working people will lose an average of £1,000 a year, as a result.

So how will tax credits change from April 2016, and who will be the winners and losers?

What are tax credits?

Tax credits are nothing to do with paying tax. They are a series of benefits introduced by the last Labour government to help low-paid families. There are two types: Working Tax Credit (WTC) for those in work, and Child Tax Credit (CTC) for those with children. Tax credits are gradually being included within Universal Credit, which is being rolled out across the country.

Who qualifies for Working Tax Credit?

The idea of this benefit is to encourage people to work. As an example, if you are single, you will need to work at least 16 hours a week, and you can earn a maximum salary of £13,253. Currently claimants earning less than £6,420 receive the full entitlement. As they earn above this level, their payments are reduced.

Who qualifies for Child Tax Credit?

To qualify for CTC you need to have at least one child, but you don't need to work. As an example, those with one child can earn up to £25,000 and still qualify for a payment. For those also claiming WTC, anyone earning less than £6,420 (the income threshold) will receive the full entitlement. For those not claiming WTC, they can earn up to £16,105 before seeing a reduction in their payments.

Who will be the losers?

The IFS has said that three million families are likely to lose an average of £1,000 a year, as a result of changes to tax credits.

But the government has argued that the introduction of the National Living Wage (NLW) will raise incomes for many people when it is introduced in April 2016. New personal allowance thresholds will also mean many people will pay less income tax.

The Resolution Foundation - which campaigns for low and middle-income families - has analysed all the changes, taking into account the NLW and new income tax thresholds.

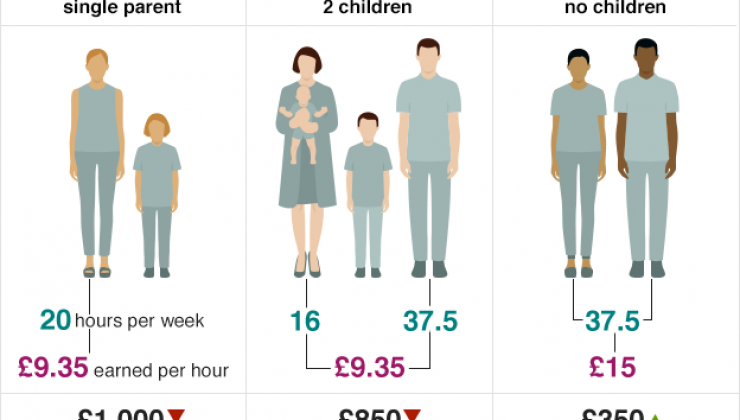

It claims that by 2020, a low-earning single parent, with one child, who works 20 hours a week, and who earns £9.35 an hour, will end up £1,000 a year worse off.

A low-earning couple with two children, also on £9.35 an hour, will be £850 a year worse off. However, a childless middle-earning couple will be £350 a year better off, as a result of the new personal tax allowance.

Who will be the winners?

Chancellor George Osborne says that anyone who is working full-time on the National Living Wage will be better off, after the tax changes are taken into consideration. However most people claiming tax credits are likely to be working part-time.

The amount anyone can earn before having to pay income tax - the personal allowance - rises to £11,000 in April 2016, with the aim of reaching £12,500 by 2020.

The Treasury says higher income tax thresholds have saved basic rate taxpayers £825 a year each since 2010, with 3.8 million people taken out of the tax system altogether.

The government is also doubling the amount of free childcare available to working parents of three and four-year olds, from 2016. It says 600,000 families will benefit. It will be worth an extra £2,500 a year

-bbc

COMMENT